These are the key details to paying what you want for a property

A good purchase begins before you even start searching for the townhouse, apartment or country home of your dreams. It’s essential to have several key factors clear in your mind at the starting line, and carry them forward with you right up to signing the contract of your purchase.

Before beginning your house hunt, you should take into consideration the following to know what you can afford to pay, and how to negotiate something outside of your budget into your affordable zone:

Research the market

Supply, demand and the price of the house are all influenced by factors such as the economy and its current state, the financial state of the owners, access to funding or credit on both sides, and the legal situation regarding real estate.

When all these factors are favorable, sales move forward smoothly and quickly – mortgages are attainable and prices will rise according to demand. On the other hand, if these conditions are precarious, demand falls and so will prices, as well as the room for negotiating on the final price of the property. Inform yourself by following the news and official sources, speak to experts and study the market in the locations of your choice. The real estate market is always transforming and taking new shapes, so it’s important to keep up to date.

Identify your budget and stick to it

What you pay for the property is always up to you, because only you know what you can and can’t afford. Choose a budget that you can stick to and afford, that includes the price of the property, associated costs (on average, these come in at 15% of the sale price) and the cost of possible renovation and furniture purchases. When taking on a mortgage, always be certain that the monthly rate is within your financial means. We recommend never paying more than 30% of your monthly income.

Speak to your banker

Whilst deciding your budget, it’s wise to consult with your financial adviser to explore financing either through mortgages or other means. Make sure to explore all options so you can pick the one that suits you best.

The shorter the payback period of the financing the better, as you’ll pay less interest even those the installments will be higher. The bank will also likely offer you incentives for each plan, so study them and compare. And make sure to check the total amount of all monthly payments combined. Once you are fully informed, compare your banks offers with other banks. A mortgage is a big commitment, so make sure you understand it inside and out.

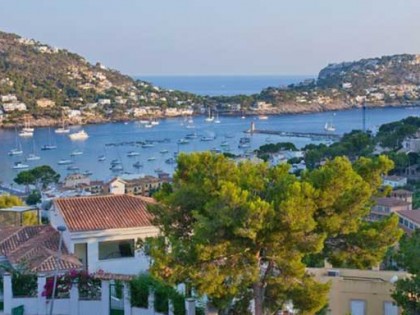

Location location location

Once you have your budget, choose you desired area. It’s important to analyse the local market as it might not fall in line with the general real estate market.

Check out the average pricing of properties which match your tastes, and find out if they’re selling quickly or if owners are eager to sell up and move on. The lower the demand, the higher your negotiating power.

Once you have found your ideal property, these are the factors that can help you what price you can get away with paying for it, and how to negotiate in your favour

Keep your emotions in check

Rash and irrational economic decisions can happen very often – they’re easy to make and can be very hard to avoid.

Stay alert, especially when you “fall in love” with a property and you neglect aspects like your budget or whether it really satisfies all of your needs. Don’t act with haste, or let yourself be pressured by any of the involved parties. Keep your cool.

Buy at your price

Remember that you’ve taken your time to identify your budget and understand your ability to take on debts. Don’t stray from the course you plotted. It’s important to remember that a good deal relies on you holding your ground.

When you make your offer, start low so that you still have to reach your “ideal” price. This way you can negotiate without exceeding your budget from the get go.

Jump the psychological barriers

If you have the budget to buy a property worth €190,000, don’t limit yourself to looking at properties below €200,000. Some property owners will list their property at, for example, €210,000, but will be willing to sell it for less.

In the current market, many owners list their properties at up to 20% above the going market price. According to the previous example, you could end up purchasing a house listed at €210,000 for only €175,000.

Create confidence

In all negotiations, it is essential to have respect, trust and confidence in the other side, such as the agent/agency or the owner themselves. A positive attitude could be what sets you above other potential buyers for the property, whilst negative energy will yield the opposite results.

As mentioned earlier, emotions play a part in our decision making, both buyers and sellers.

Be creative

Many stagnant negotiations can end up finding the end of the tunnel thanks to lateral thinking from either side. Maybe you’ve calculated €190,000 for the purchase and €20,000 to invest in the property – but the owner wants €200,000.

In this case you could suggest upping your offer if certain repairs or renovations are carried out – creating a “win/win” scenario: the owner gets their desired sale price, and you don’t break your budget.

All in all, it’s important to do your homework and keep a steady hand, never rushing into unknown waters. Keep your cards close to your chest whilst figuring out what the other person sitting at the negotiating table wants, and it’s within your power to get a great deal and play the market!